这是一篇11年前于2013年3月5日,山姆 奥特曼写的一篇探讨了经济增长和政府的关系。他认为,政府可以在某些情况下促进经济增长,但在其他情况下,政府的干预可能会阻碍经济增长。

作者提到,政府可以通过提供教育和基础设施来促进经济增长,这些投资可以帮助提高人们的技能和生产力,并促进创新。此外,政府还可以通过减少管制和税收来鼓励企业家精神和创新。

然而,作者也指出了政府过度干预可能会对经济产生负面影响。他认为,政府应该避免过度管制和税收,并确保市场能够有效地运作。如果政府过度干预市场,可能会导致资源的浪费和低效率。

总之,作者认为政府可以在某些情况下促进经济增长,但需要谨慎地权衡利弊,并确保市场能够自由运作。

Growth and Government 增长与政府

TL;DR Without economic growth, democracy doesn’t work because voters occupy a zero-sum system.

TL;DR:没有经济增长,民主就无法运作,因为选民占据的是零和博弈体系。

The first piece of startup wisdom I heard was “increasing your sales will fix all problems”. This turns out to be another way of phrasing Paul Graham’s point that growth is critical, which is true for all sorts of reasons—for example, justifying high valuations to raise large amounts of capital in the early days, attracting the best people and paying them with equity, providing a buffer to allow for some mistakes, and smoothing over internal tensions.

我听到的第一条创业智慧是“增加销售额将解决所有问题”。 事实证明,这是保罗·格雷厄姆(Paul Graham)的观点的另一种表达方式,即增长至关重要,出于各种原因,这都是正确的——例如,在早期证明高估值以筹集大量资金是合理的,吸引最优秀的人才并以股权支付他们,提供缓冲以允许一些错误, 并抚平内部紧张局势。

I believe that growth is not only critical for startups, but for most systems. Either you’re growing, or you’re slowly dying. Perfect equilibrium is rare.

我相信增长不仅对初创公司至关重要,而且对大多数系统也至关重要。 要么你在成长,要么你在慢慢死去。 完美的平衡是罕见的。

One system that seems to be in early death throes is the United States government. There’s a lot of political rancor, which is particularly puzzling when one considers that in the 2012 presidential election, Obama and Romney said roughly the same thing. Dysfunction is high—the sequester, which was supposed to be so unpalatable it would never take effect, actually (and likely temporarily) happened last Friday because the parties couldn’t agree on an alternative. There’s a lot of arguing over insignificant issues—enough, in fact, to distract us from the fact that no one has new ideas on the big issues. We have trillion dollar deficits and no plan to reduce them, and yet the media focus on the sideshows.

一个似乎处于早期死亡阵痛中的系统是美国政府。 有很多政治仇恨,当人们考虑到在2012年总统大选中,奥巴马和罗姆尼说了大致相同的话时,这尤其令人费解。 功能失调很严重——本来应该非常难吃以至于永远不会生效的隔离,实际上(而且可能是暂时的)发生在上周五,因为双方无法就替代方案达成一致。关于无关紧要的问题有很多争论——事实上,这足以分散我们的注意力,让我们忽视这样一个事实,即没有人对重大问题有新的想法。 我们有数万亿美元的赤字,但没有减少赤字的计划,但媒体却把注意力集中在杂耍上。

A good metric for government dysfunction is inability to pass a budget, either leading to a government shutdown or a continuing resolution, which lets agencies continue to operate on the previous budget, for a theoretically short time period until we can agree on a new one. Passing a budget is a fundamental job of Congress and the President.

衡量政府功能失调的一个很好的指标是无法通过预算,要么导致政府关闭,要么导致持续决议,这让各机构在理论上很短的时间内继续按照以前的预算运作,直到我们能够就新的预算达成一致。 通过预算是国会和总统的一项基本工作。

As far as I can tell, the US government managed to make it about 200 years without any shutdowns. We had one in 1976, and then a bunch more in the 70s and 80s, plus 3 in the 90s, including one that lasted 21 days. Shutdowns have fallen out of fashion, and now we just operate with continuing resolutions, and lots of them—for example, 21 for the 2001 budget alone. The real issue with shutdowns and continuing resolutions is the same—inability to agree on a federal budget.

据我所知,美国政府设法做到了大约 200 年而没有任何停工。 我们在 1976 年有一个,然后在 70 年代和 80 年代又有一堆,再加上 90 年代的 3 个,包括一个持续了 21 天。 停摆已经过时了,现在我们只是在持续的决议下运作,而且很多决议——例如,仅2001年预算就有21项决议。 关门和持续决议的真正问题是一样的——无法就联邦预算达成一致。

Every few months, there’s brief discussion of some sort of grand bargain, but it always ends in deferral—even the deferrals get deferred! Everyone feels screwed, and almost no one feels like the government is doing a great job. We can’t agree on anything, and anyone that proposes doing something radically different doesn’t get elected.

每隔几个月,就会有关于某种大交易的简短讨论,但它总是以推迟而告终——即使是推迟也会被推迟! 每个人都觉得自己搞砸了,几乎没有人觉得政府做得很好。 我们无法就任何事情达成一致,任何提议做一些完全不同的事情的人都不会当选。

But democracy (I’m using democracy to include republics and other forms of government where the people get an effectively direct say in who the leaders are) worked in the US for a long time—we were able to make real progress, pass budgets, be the world superpower, evolve as a country, etc. Something has changed.

但是民主(我用民主来包括共和国和其他形式的政府,人民对谁是领导人有有效的直接发言权)在美国工作了很长时间——我们能够取得真正的进步,通过预算,成为世界超级大国,作为一个国家发展,等等。 有些事情发生了变化。

The US has been blessed with economic growth for a very long time, first due to natural resources and massive amounts of land in which to expand, and then due to a period of technological progress rarely matched in human history that lasted approximately until we realized just how dangerous nuclear bombs really were and got scared of new technology. But the frontier is long over, and although technological innovation has continued at a blistering rate for computers and the Internet, it seems to have slowed down in most other industries.

很长一段时间以来,美国一直享有经济增长的福气,首先是由于自然资源和大量可供扩张的土地,然后是由于人类历史上罕见的技术进步时期,这种进步大约持续到我们意识到核弹到底有多危险并害怕新技术。 但这个前沿早已结束,尽管计算机和互联网的技术创新继续以极快的速度发展,但在大多数其他行业似乎已经放缓。

Growth may be the root cause of American exceptionalism—things consistently got better every decade largely because we were growing. People from other countries wanted to live here, we led the world in technological innovation, social mobility was high because everyone was getting richer, and we had the resources to get involved around the world. This is still at least partially true.

增长可能是美国例外论的根本原因——情况每十年就会变得更好,这主要是因为我们在成长。 来自其他国家的人们想住在这里,我们在技术创新方面引领世界,社会流动性很高,因为每个人都越来越富有,我们有资源参与世界各地的活动。 这至少部分是正确的。

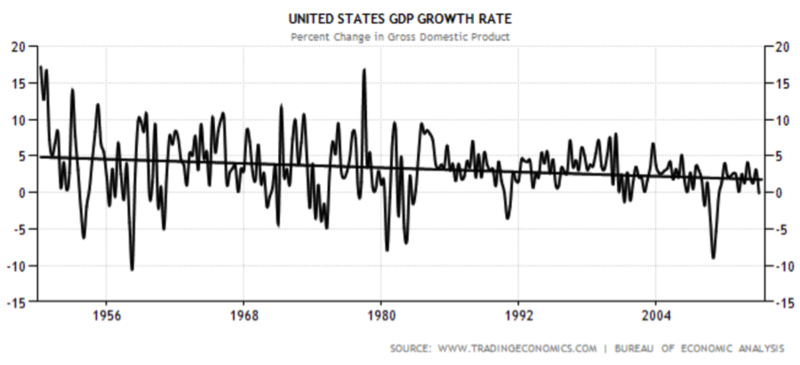

But growth has slowed quite a bit. Here is a graph of real GDP percentage growth in the United States from 1950 until now, with a trendline. The trendline goes from just under 5% to just under 2%. This is a much more significant drop than it appears, because it compounds exponentially.

但增长已经放缓了不少。 这是一张从1950年至今美国实际GDP增长百分比的图表,并带有趋势线。 趋势线从略低于 5% 到略低于 2%。 这是一个比看起来要大得多的下降,因为它呈指数级复合。

A shocking data point about how things are going is that the median real net worth for households headed by someone under 35 dropped 68% from 1984 to 2009, to $3,662. For those over 65, it increased 42% to $170,494 (largely due to a gain in property values). This disparity is good evidence of a lack of real growth (and also a very unstable situation where an older generation benefits at the expense of a younger).

关于事情进展的一个令人震惊的数据点是,从1984年到2009年,以35岁以下的人为户主的家庭的实际净资产中位数下降了68%,至3,662美元。对于65岁以上的人,它增加了42%,达到170,494美元(主要是由于房产价值的增加)。这种差距很好地证明了缺乏实际增长(也是一种非常不稳定的情况,即老一代人以牺牲年轻人为代价而受益)。

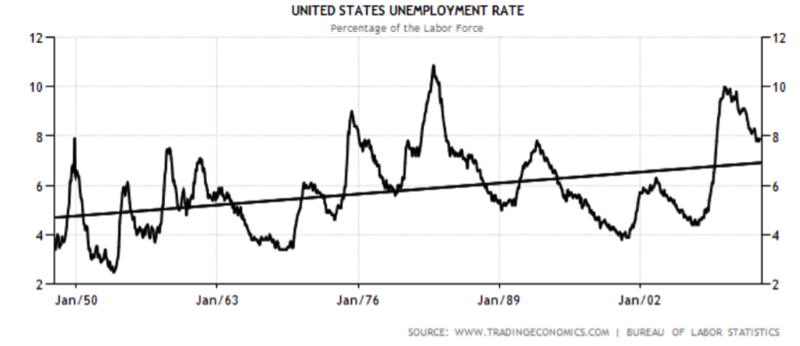

Here are two more graphs, the first showing the US unemployment rate (the real numbers are perhaps worse, as people drop out of the work force) and the second showing the US interest rate, both of which make a case for slowing growth:

这里还有两张图表,第一张显示美国失业率(实际数字可能更糟,因为人们退出劳动力市场),第二张显示美国利率,两者都表明经济增长放缓:

Most of us want our lives to get better every year—the hedonic treadmill is a pain that way. In a democracy, we theoretically vote for what we believe will improve our lives the most. In a system with economic growth, things can improve for everyone. In a system without growth, or even one with very little growth, that’s not the case—if things improve for me, it has to come at the expense of things getting worse for you. Without growth, we’re voting against someone else’s interest as much as we’re voting for our own. This ends with lots of fighting and everyone feeling screwed, broken into factions, and unmotivated. Democracy does not work well in a zero-sum world. Autocratic political systems probably work better with growth too, but the effect of a lack of growth is likely less pronounced right up until the revolution.

我们大多数人都希望我们的生活每年都变得更好——享乐跑步机就是这样一种痛苦。在民主国家,从理论上讲,我们会投票选出我们认为最能改善我们生活的东西。在一个经济增长的体系中,每个人都可以改善情况。在一个没有增长的系统中,甚至在一个几乎没有增长的系统中,情况并非如此——如果事情对我来说有所改善,那一定是以你变得更糟为代价的。没有增长,我们就是在投票反对别人的利益,就像我们投票支持自己的利益一样。这以大量的战斗结束,每个人都感到被搞砸了,分裂成派系,没有动力。民主在零和博弈的世界里运作不通。专制政治制度在增长方面可能也更有效,但缺乏增长的影响可能直到革命之前才那么明显。

So we need to get growth back, unless we want to see this grand experiment end. Our politicians don’t seem to have any good ideas about how to do this. Saying “I believe in America” and hoping that proof by vigorous assertion starts working is not a strategy.

因此,我们需要恢复增长,除非我们想看到这个伟大的实验结束。 我们的政客们似乎对如何做到这一点没有任何好主意。 说“我相信美国”,并希望通过有力的断言来证明开始起作用,这不是一种策略。

I believe democracy only works in a non-zero-sum world. We are losing jobs that we will never get back, we are borrowing money and spending it on anything but real investment, and it feels like we are managing a slow decline. Without growth, we will head towards a special case of Malthusian dystopia where we have plenty of junk food but not enough of anything else.

我相信民主只有在非零和博弈的世界中才能发挥作用。 我们正在失去永远无法挽回的工作,我们正在借钱并将其花在除实际投资之外的任何事情上,感觉我们正在缓慢下降。 没有增长,我们将走向马尔萨斯反乌托邦的一个特例,在那里我们有很多垃圾食品,但其他任何东西都不够。

Growth is what we should be focusing on. Growth is great—it lets us run deficits, it means the country is not zero-sum, it lets us invest in innovation and continual improvement in infrastructure, it provides a buffer for a little mismanagement, and it means tomorrow will be better than today. Contrary to what one might expect, growth provides long-term stability.

增长是我们应该关注的。 增长是伟大的——它让我们能够实现赤字,这意味着国家不是零和博弈,它让我们投资于创新和基础设施的持续改善,它为一点管理不善提供了缓冲,这意味着明天会比今天更好。 与人们的预期相反,增长提供了长期的稳定性。

We must return to real growth, growth where we do more with less. Borrowing money to get ninety growth cents on the dollar does not count, although that may work for a while. We have to figure out how to fix the real problems with technological innovation—cheaper and cleaner energy, better healthcare (15.2% of GDP in 2008 and 18.2% of GDP in 2011), better transportation, food production, and defense. GDP growth is probably the only way to fix our national debt and entitlement problems, and it’d be better to have real growth than inflationary growth.

我们必须回归真正的增长,即我们用更少的资源做更多的增长。 借钱以获得90美分的美元增长不算数,尽管这可能会在一段时间内奏效。 我们必须弄清楚如何通过技术创新来解决真正的问题——更便宜、更清洁的能源、更好的医疗保健(2008年占GDP的15.2%,2011年占GDP的18.2%)、更好的交通、粮食生产和国防。 GDP增长可能是解决我们国家债务和福利问题的唯一途径,实际增长比通货膨胀增长要好。

How to best drive economic growth is a difficult question. It’s easy to say we should just invest in science and technology, and although that’s probably right it’s easier said than done. The government is historically bad at picking winners to invest in, but our leaders can perhaps help reverse the cultural shift from pro-science to anti-science. Our current culture has shifted to be anti-science; the fear of things like genetically modified food and robots is obviously in the way of growth.

如何最好地推动经济增长是一个难题。 说我们应该投资科学技术很容易,虽然这可能是对的,但说起来容易做起来难。 从历史上看,政府不善于挑选赢家进行投资,但我们的领导人或许可以帮助扭转从亲科学到反科学的文化转变。 我们目前的文化已经转变为反科学;对转基因食品和机器人等事物的恐惧显然阻碍了增长。

We should strive to make jobs in science and technology more appealing than jobs in finance (incidentally, it should be a big red flag for growth when the brightest young people start going into finance, since they aren’t actually creating any more wealth, just redistributing it). Startups are probably the best way to do this—startups let people that develop a new technology get rich, instead of just making GE slightly richer. So we should encourage startups in whatever way we can.

我们应该努力使科学和技术领域的工作比金融领域的工作更具吸引力(顺便说一句,当最聪明的年轻人开始进入金融领域时,这应该是增长的一大危险信号,因为他们实际上并没有创造更多的财富,只是重新分配财富)。 创业公司可能是做到这一点的最好方式——创业公司让开发新技术的人致富,而不仅仅是让通用电气稍微富裕一点。 因此,我们应该尽我们所能鼓励创业公司。

Another issue is the structure of our national budget. We have, in startup parlance, a high burn, and most of it can’t be considered ‘investment’ but is instead ‘expense’. Spending money on things like infrastructure improvement or new technology that are likely to generate more money in the future helps growth; spending money on the so-called entitlement programs, and parts of the military, does not. Of course medical care and defense are important, and we have to have them—this is a tough balancing act. In some cases, the competitive nature of the private sector may provide a better path. Sooner or later, we are going to have an ugly conversation about our national budget—we can delay it for a long time but not forever. The government, when it needs to spend money at all, should aim to invest. Considering what will drive growth is a useful framework for thinking about the best use of resources.

另一个问题是我国国家预算的结构。 用创业公司的话来说,我们有很高的消耗,其中大部分不能被视为“投资”,而是“费用”。 把钱花在基础设施改善或新技术等可能在未来产生更多资金的事情上有助于增长;把钱花在所谓的福利计划和部分军队上,则不会。 当然,医疗和防御很重要,我们必须拥有它们——这是一个艰难的平衡行为。 在某些情况下,私营部门的竞争性质可能提供更好的途径。 迟早,我们将就我们的国家预算进行一场丑陋的对话——我们可以推迟很长时间,但不会永远拖延。 当政府需要花钱时,它应该以投资为目标。 考虑什么将推动增长是思考资源最佳利用的有用框架。

We should not fear innovation or globalization. Robots are going to replace human workers in lots of factories; jobs that do require human labor are going to continue to move to the lowest-cost place. But that’s ok, and these sorts of jobs are not what will generate economic growth for us anyway. We should strive to be a net exporter of ideas and technologies. For example, the US makes the best software in the world today. It’d be disastrous for us if that stopped happening. We should also design the best supersonic jet engines, the best nuclear power plants, and the best agricultural technology.

我们不应该害怕创新或全球化。 机器人将取代许多工厂的人类工人;确实需要人力的工作将继续转移到成本最低的地方。 但这没关系,无论如何,这些工作都不会为我们带来经济增长。 我们应该努力成为思想和技术的净输出国。 例如,美国制造了当今世界上最好的软件。 如果这种情况停止发生,对我们来说将是灾难性的。 我们还应该设计最好的超音速喷气发动机、最好的核电站和最好的农业技术。

We should understand that as a consequence of technology and an economy of ideas, the gap between the rich and the poor will likely increase from its already high-seeming levels. There is good and bad to this, but we should be careful not to legislate against it, which will hurt growth. Technology magnifies differences in innate ability; startups provide a framework to get compensated for it. But GDP growth ought to improve the quality of life for everyone, and no growth will reduce quality of life for everyone except the very rich. A safety net for legitimately poor people is a good thing, and probably becomes more necessary in a world with this sort of divergence. Quality of life should improve for everyone; the bigger issue will likely be that people are very sensitive to relative fairness.

我们应该明白,由于技术和思想经济,贫富差距可能会从已经很高的水平扩大。 这有好有坏,但我们应该小心,不要立法反对它,这会损害增长。 技术放大了先天能力的差异;初创公司提供了一个框架来获得补偿。 但GDP增长应该改善每个人的生活质量,除了富人之外,任何增长都不会降低每个人的生活质量。 为合法的穷人提供安全网是一件好事,在一个存在这种分歧的世界里,它可能变得更加必要。 每个人的生活质量都应该得到改善;更大的问题可能是人们对相对公平非常敏感。

Pro-growth tax and legal changes are a good idea. As a consequence of a high burn rate, we have to have high taxes. But other countries don’t have this structural challenge, and so some other countries have lower tax rates than we do. That makes them an appealing place to start a business or live. By reducing our burn rate, we can reduce taxes. We don’t need to go crazy here—there are a lot of other factors that make the US a very attractive place to start a new company. But it would certainly help. And tax policy should reward activity that drives growth.

促进增长的税收和法律变化是个好主意。 由于高烧钱率,我们必须征收高税。 但其他国家没有这种结构性挑战,因此其他一些国家的税率比我们低。 这使它们成为创业或居住的有吸引力的地方。 通过降低我们的燃烧率,我们可以减少税收。我们不需要在这里发疯——还有很多其他因素使美国成为创办新公司的非常有吸引力的地方。 但这肯定会有所帮助。 税收政策应该奖励推动增长的活动。

There are some easy legal changes we can make to increase growth. Immigration for entrepreneurs and skilled technology workers is an obvious one; we should want the best people creating value here, not elsewhere in the world. Tort reform is another—legal protection is of course important, but it’s gotten so silly that it discourages innovation.

我们可以做出一些简单的法律改变来促进增长。 企业家和熟练技术工人的移民是显而易见的;我们应该希望最优秀的人才在这里创造价值,而不是在世界其他地方。 侵权法改革是另一回事——法律保护当然很重要,但它变得如此愚蠢,以至于阻碍了创新。

There is a lot more we can do. Most of it is difficult, but growth it is the critical issue.

我们可以做的还有很多。 其中大部分是困难的,但增长是关键问题。

As a closing thought, the Airbnb founders used to draw a forward-looking growth graph that they wanted to hit. It was their number one priority; they put it up on their desks, on their refrigerator, and on the mirror in their bathroom. You build what you measure, and they built growth. That seemed to work pretty well for them.

最后,Airbnb的创始人曾经画出他们想要达到的前瞻性增长图。 这是他们的首要任务;他们把它放在桌子上、冰箱上和浴室的镜子上。 你建立你所衡量的东西,他们建立增长。 这对他们来说似乎很有效。

It’s not as easy if you’re the US government. But probably not impossible, either, and it would at least point us in the right direction.

如果你是美国政府,那就没那么容易了。 但可能也不是不可能,它至少会为我们指明正确的方向。